Tracing Speculation

An investigation of real estate geographies in pre- and post-crisis Philadelphia, PA.

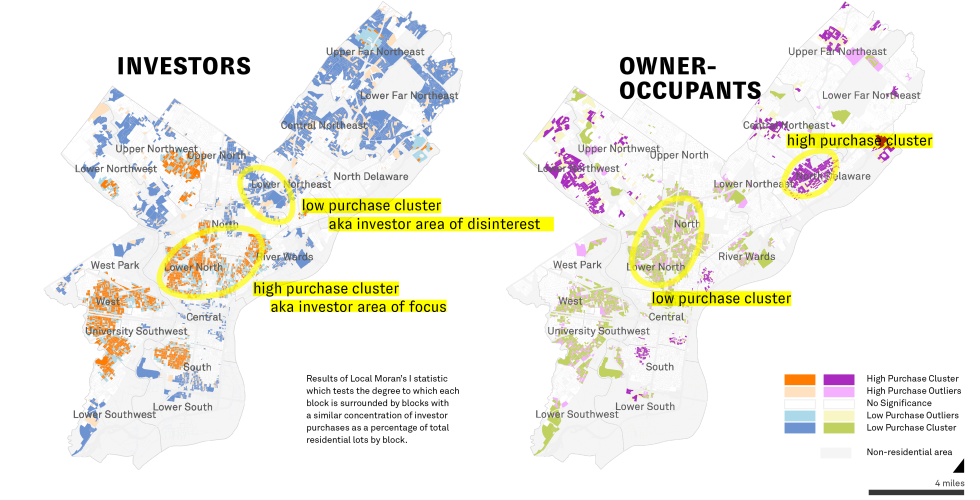

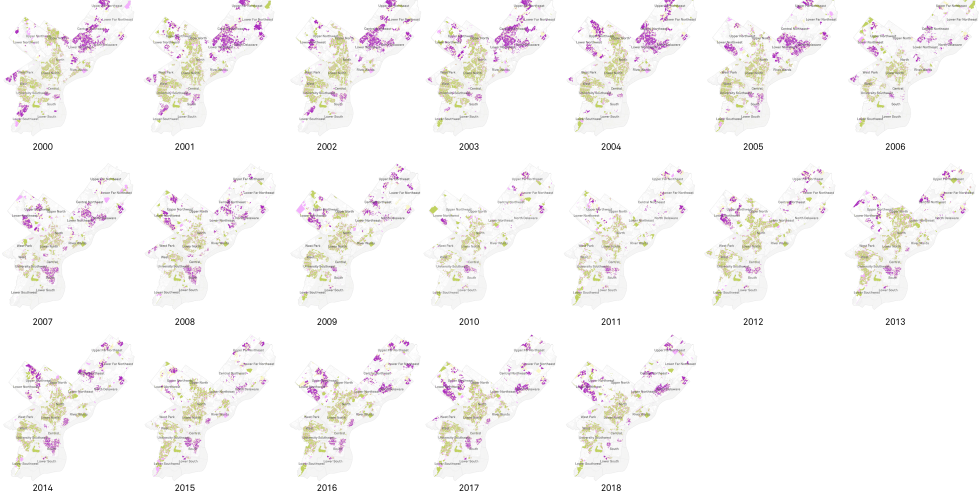

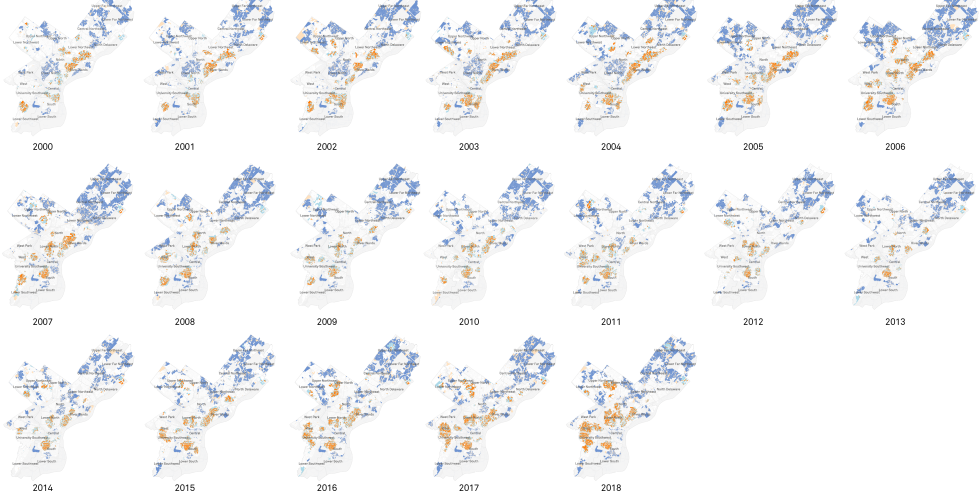

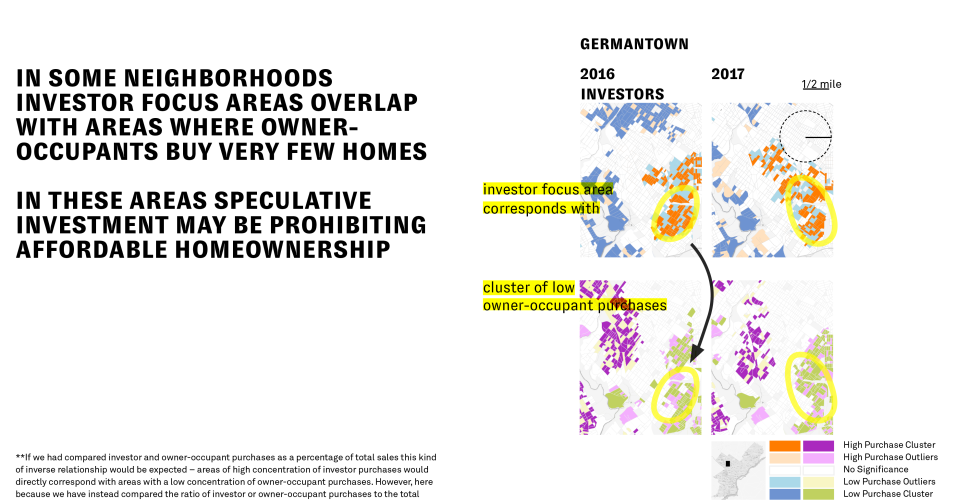

This project investigates forms of investment in residential property that began to emerge in the lead up to the 2008 financial crisis, which have since morphed and firmly taken hold. Focused on Philadelphia, PA, the analysis traces the new geographies of real estate purchases made specifically by investors who do not intend to live in the homes they are buying. The project uses a mixed methods approach to uncover how houses purchased as investment vehicles between 2000-2018 have been concentrated spatially, then compares these patterns with the geography of houses that have been purchased as homes.

The research shows that investors have consistently focused their efforts on Philadelphia neighborhoods with a higher proportion of residents of color and lower incomes. As well, over the nineteen-year span covered by the data, it is clear that investor activity not only played a large role in the housing bubble in Philadelphia, but is also continuing to grow as a percentage of overall purchases, and is expanding into new areas of the city. Principally, the project reveals that the geographies of purchases by investors and owner-occupants are largely distinct–investor ownership is fueling a separate housing geography and is not merely a part of the overall housing market.

In the context of Philadelphia, the project brings together research on the political economic implications of Financialization in housing together, neighborhood-level impacts of house 'flipping’, as well as the new single-family rental (SFR) asset class.